Compare Todays Mortgage and Refinance Rates in Los Angeles, CA

Table Of Content

You can get a certificate of occupancy at your local building or zoning inspection office. Your municipality will typically send an inspector to review the property to ensure it’s up to code. If you pass the inspection, you can finally receive your certificate, and if you don’t pass, you’ll need to make the necessary repairs before reapplying. A temporary buydown can be a good option, but you need to be aware of the risk when the rate resets. Here are some quick answers, mainly provided by Gevurtz, to frequently asked questions about construction loans.

When Do You Start Paying Mortgage On a New Build?

The main difference from other loans is that you apply for your loan when you sign the contract with the builder, but you don’t lock in the loan terms until the property is complete. The lender will then disburse funds at each stage of the construction process, generally after an inspection is completed to ensure that the work has been completed per the plans and specifications. The builder will submit a request for a draw, and the lender will release funds for the work that has been completed.

Choose A Builder

However, we can help you when the time comes to get a permanent end loan. A construction-only loan provides the funds necessary to build the home, but the borrower is responsible for repaying the loan in full at maturity (typically one year or less). You can settle the debt either in cash or by obtaining a mortgage to pay it off.

Low-interest loan programs promote home construction - WPR

Low-interest loan programs promote home construction.

Posted: Mon, 01 Apr 2024 07:00:00 GMT [source]

Best Construction Mortgage Lenders

If you already own the land, you may be able to use the property as collateral for your loan. Because construction loans generally are intended to cover the building process, they’re typically issued for a period of 12 to 18 months. That said, some loans automatically convert into a permanent mortgage once construction is complete. Many lenders won’t offer construction loans to someone planning to build their home on their own without an approved contractor. The exception to this is borrowers who are also professional builders, contractors, or experienced in the home-building process. Lenders will generally ask potential owner-builders to provide extensive home-building plans as well as documentation of their home-building experience.

They can’t work with owner-builders, investment property, or manufactured homes, but if you fall outside of that category (e.g. a primary residence or a second home), then you may like the options. In California, a shortage in available homes for sale and soaring rents have pushed home prices to all-time highs. To finance these construction projects, Californians are turning to a construction loan to help build their dream home.

Kit Homes: What You Should Know Before Buying

The approval process involves evaluation of your income, financial statements, debt and credit history to determine the amount you can be financed with. A renovation loan gives homeowners access to funds necessary to make any major structural and aesthetic change. The loan amount is therefore based on the homes’ predicted value after renovation. With these types of construction loans, you might consider one if you don’t need a whole mortgage but just enough cash for a home overhaul or a home addition. The funds granted may cover costs such as installing or updating heating and cooling systems, energy improvements, mold remediation, or renovating the kitchen and bathroom to add more value to your home. Custom home financing is a loan granted for the purpose of building your dream home and other real estate properties.

So, the loan helps cover the building timeline and then, assuming all goes to plan, turns into a mortgage with a typical monthly payment schedule. With a construction-to-permanent loan you’re only dealing with one set of applications and closing costs. Construction loans are short-term loans that cover the cost of building a new home. These loans are usually shorter in duration and are paid directly to the contractor in installments, or “draws,” as building milestones are met. An inspection is typically required before each payment is released to the contractor. To learn more about how construction loans work, connect with one of our construction-certified mortgage loan officers.

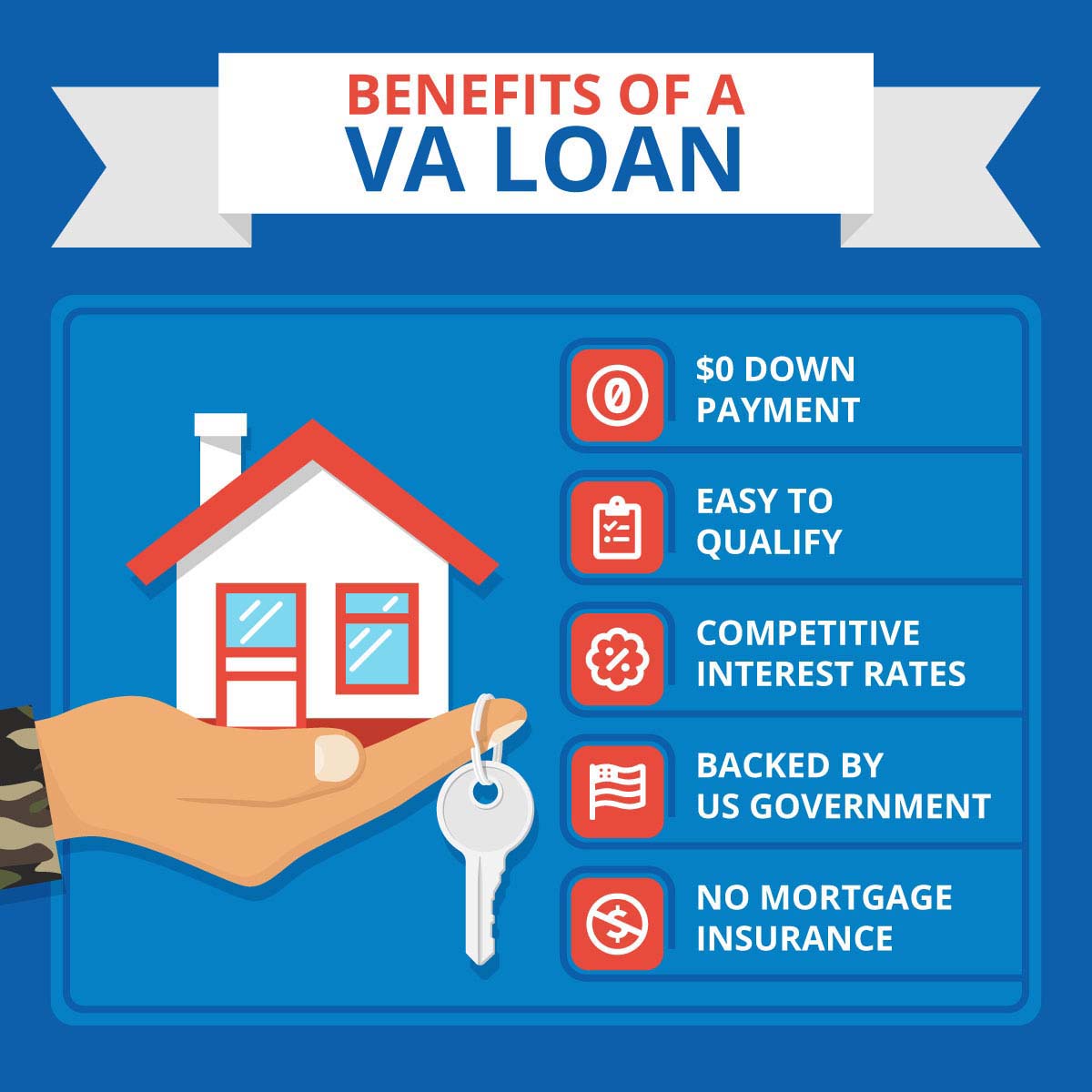

Once construction is complete and your new home is built, you’ll likely convert the home construction loan into a permanent mortgage with a lender. At that point, you will start to make monthly payments on both the principal and interest. These types of loans can be much more expensive than traditional mortgages, so if you decide to go in this direction, shop around, compare rates and find the best deal before you pull the trigger. If you’re an active-duty service member or veteran, you may even qualify for a VA construction loan from the Department of Veterans Affairs (VA). The initial term on a construction loan generally lasts a year or less, during which time you must finish the project.

Mortgage Rates by State

The first thing to consider is the lenders’ expertise with construction loans, the types they offer, and the interest rates available. Best of all, opt for a lender who has gone through the homebuilding experience numerous times and has a strong sense of what can go wrong and how to avoid problems. These are construction loans available to homeowners looking to undertake a building project. They include construction-to-permanent loan, construction-only loan, owner-builder loan, and renovation loan.

Preapprovals are not available on all products and may expire after 90 days. Renovation loans are for buyers who want to finance the repair or remodeling of a home. They can often be bundled with a standard mortgage, included as part of a refinancing plan or taken out as a personal loan, depending on your lender. For example, you may have found a home with potential in the right location, but there is a good amount you want to change about it. You might find renovation loans sponsored by both private and government lenders.

One notable downside of construction loans is that they usually have higher interest rates than traditional mortgages. Construction loan interest rates are higher because lenders see them as high-risk, as no home exists yet to serve as collateral should the borrower default. Higher rates also serve as an incentive for builders to complete the project in a timely fashion. With a traditional mortgage, typically a loan term of 15 to 30 years, you make payments that cover both interest and the principal.

Comments

Post a Comment